|

~~TAX TALK-30.05.2016-THE HITAVADA ~~TAX TALK-30.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

No excuse, Purchasing property below stamp duty valuation is taxable

Query 1]

1. My friend purchased house at Hingna jointly with his brother, sale deed executed in May-2014. Actually, purchase agreement was signed by paying Rs. 60,000/- in Sept-2005 with value of house as Rs. 17.60 lakhs. But, thereafter dispute broke and matter was taken to court by my friend. In lower court, my friend won and balance amount was deposited in court. Seller went to High Court and case was pending there. In the meantime, compromise took place between the parties; value of house raised, fixed & settled at Rs. 40 lakh. Accordingly, sale deed executed but stamp duty paid on ready reckoner value of Rs 72 lakhs. Now, as purchaser, income-tax department issued a notice to pay 1% TDS, considering value as Rs. 72 lacs instead of actually paid amount Rs. 40 lakhs by demand draft. In the sale deed, one para mentioning court case details is incorporated. Due to court matter, actual real value of house is 40 lacs which is less than Rs 50 lacs, the limit prescribed for 1% TDS. My query is, if my friend replies to notice accordingly to IT department, will it withdraw their demand? Please advice and suggest. [Lalit Tapase- tapaselalit01@gmail.com]

2. There are changes in the amount which attracts TDS in the recent budget. Can you please elaborate and update the change in the TDS rate along with the applicability date thereof? [KCL, Raipur]

Opinion:

Tax Deduction at Source (TDS) is one of the major source of tax collection, by which a certain percentage of a transaction amount is deducted by a person at the time of making payment or crediting certain specific nature of payment to the other person, and the deducted amount is remitted to the Government account on behalf of payee. It ensures regular inflow of cash resources to the Government & acts as a powerful tool to control tax evasion.

As far as first query is concerned, it may be noted that:

1. All the taxpayers who are purchasing an immovable property (other than prescribed RURAL agricultural land) of Rs. 50 Lacs or more from resident person are duty bound [u/s 194IA] to deduct & remit income tax (i.e., TDS) @ 1%. Please note that TDS provision is not applicable where the consideration for transfer of an immoveable property is less than Rs. 50 Lacs.

2. Where immovable property is transferred at a value less than the value adopted for stamp duty purposes, the stamp duty value would be deemed to be sale consideration for such transfer for the purpose of calculating capital gain tax. However, such value is only for computation of capital gains and would not impact TDS U/s 194IA. TDS is required to be done on the actual sale value only and not on the ready reckoner value or guideline value or Government valuation.

3. In your specific case, as the property purchased by your friend was below Rs. 50 Lacs and so no liability towards TDS was there. Your friend may respond to the notice received from income tax department with the specific fact & documentary evidence thereof & TDS proceeding would be dropped.

[For other Readers who have failed to comply with the TDS provision at the time of Purchasing the Property: Taxpayers who have purchased property of more than Rs. 50 Lacs without complying with the TDS provision U/s 194IA are now facing the unpleasant music from the income tax department. In case of failure of the buyer to deduct tax at source, buyer will have to pay interest & penalty along with TDS amount. However, purchaser could get a relief if the seller has filed the return of income incorporating income from sale of such property & furnishes CA certificate to the seller in Form No. 26A. In such case, the TDS amount cannot be recovered from the buyer. Thanks to proviso inserted in section 201 by the Finance Act-2012.]

4. Though, your friend could be relieved from the present notices of TDS non compliance, there is something more rigorous provision that could follow. Gone are the days when the income tax liability was the result of actual income. Now, the tax liability could arise without actual income like in the present case.

5. By the Finance Act-2013, Section 56(2) has been amended so as to provide that if any individual or HUF purchases any immoveable property for an inadequate consideration (i.e., if the stamp duty valuation of the property is more than the actual purchase price) and the difference between stamp duty valuation and actual purchase price is more than Rs.50,000/-, then such difference shall be taxable in the hands of the purchasing individual or HUF as “Income from Other Source”. For this purpose, stamp duty valuation as on the date of agreement to sale could be considered if any part of the consideration is paid by the purchaser otherwise than in cash.

6. Your friend has purchased the property for Rs. 40 Lacs as against its government Value / Stamp duty value of Rs. 72 Lacs. Irrespective of the nature of disputes or legal proceedings in the court, Rs. 32 Lacs (72 Lacs less Rs. 40 Lacs) could be treated as income of your friend in the FY 2014-15 U/s 56(2)(vii)(b) of the Income Tax Act-1961. The amount of Rs. 72 Lacs could be replaced by the stamp duty value prevailing at the time of advance payment in September-2005 if such advance amount of Rs. 60,000/- was paid otherwise than in cash.

Second Query:

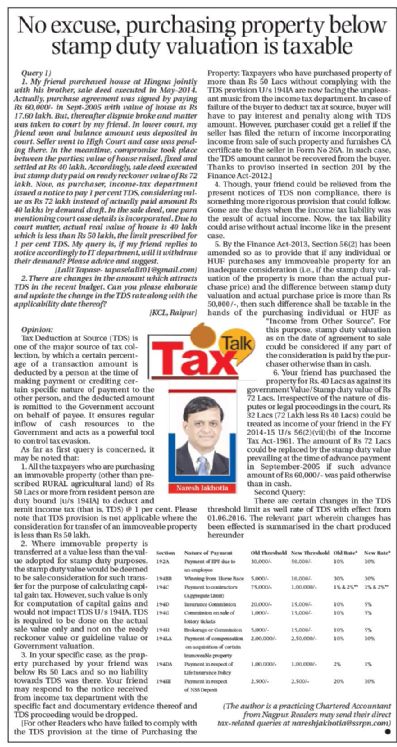

There are certain changes in the TDS threshold limit as well rate of TDS with effect from 01.06.2016.The relevant part wherein changes has been effected is summarized in the chart produced hereunder:

~~

Section Nature of Payment Old Threshold New Threshold Old Rate* New Rate*

192A Payment of EPF due to an employee 30,000/- 50,000/- 10% 10%

194BB Winning from Horse Race 5,000/- 10,000/- 30% 30%

194C Payment to contractors

(Aggregate Limit) 75,000/- 1,00,000/- 1%

or

2%** 1% or 2%**

194D Insurance Commission 20,000/- 15,000/- 10% 5%

194G Commission on sale of lottery tickets 1,000/- 15,000/- 10% 5%

194H Brokerage or Commission 5,000/- 15,000/- 10% 5%

194LA Payment of compensation on acquisition of certain immoveable property 2,00,000/- 2,50,000/- 1% 1%

194DA Payment in respect of Life Insurance Policy 1,00,000/- 1,00,000/- 2% 1%

194EE Payment in respect of NSS Deposit 2,500/- 2,500/- 20% 10%

* TDS would be required @ 20% (or normal rate if it is higher than 20%) if no PAN is provided by the payee.

** 1% if payment is to be done to Individual/HUF & 2% for others.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at nareshjakhotia@ssrpn.com.]

|

.png)