TAX TALK-16.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

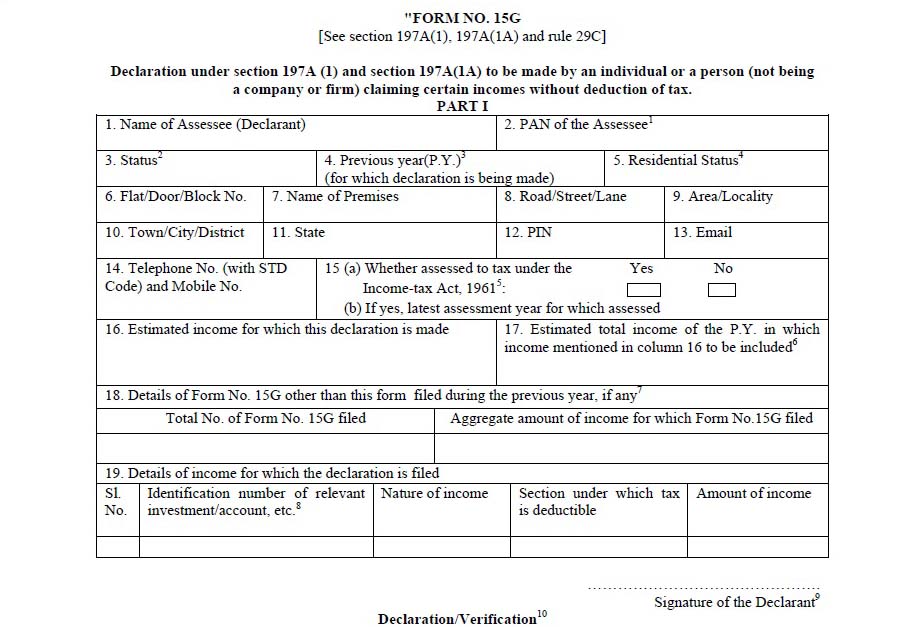

Intricacies in Columns of revised Form No. 15G & 15H

Query 1]

This is with regard to introduction of new Form 15G and 15H. The main area of contention is with respect to three areas which are as under:

- Estimated income for which declaration is made (Column 15 )

- Estimated total income of the P.Y. in which income mentioned in column 15 to be included (Col 16)

- Aggregate amount of income for which Form No.15H filed ( Col No.17)

I would like to quote an example to arrive at correct picture. Suppose a pensioner earns interest income of Rs. 20,000/- from a particular Bank say “A” Bank. He is also having deposit with other bank say “B” bank, the interest income from which comes to say Rs. 5,000/-. He also earns pension of say Rs. 1,20,000/- per annum.

Now while filing Form 15H, the depositor will show his Estimated income (Column No. 15) for which declaration is made as Rs. 20,000 + 5,000 i.e., 25,000/- and his Estimated Total Income (in Col. 16) will be Rs. 1,45,000/- (Rs. 1,20,000/- Pension Plus Rs. 25,000/- Interest Income). Now my question is, what will be the Aggregate amount of income for which 15 H is filed? Now there is different school of thought with regard to Aggregate income. Some says it has to be difference of Col No.16 and Col No.15. i.e., Rs. 1,45,000-Rs. 25,000 i.e., Rs. 1,20,000/-, while some says interest earned from other banks other then where form 15H filed is to be mentioned. i.e., Rs. 5,000/-

There are lots of confusions regarding this. Also the menu Form No. 15G introduced in Banks system automatically calculates the interest income from a customer ID. So, in the instant case, it will calculate only Rs. 20,000/-. Also while submitting the form 15G or H in Bank “A” and Bank “B”, whether the figure in above columns will remain same?

Now the depositor makes further deposit and earns further interest of Rs. 10,000/- . In which column the same will be accommodated? Kindly advice the correct position in this regard as both customer and bankers are having confusion in this regard. [MURLI [V. Iyer- murli.iyer62@gmail.com]

Opinion:

“It’s a nice feeling you get when you receive a tax refund until you realize it was your own money in the first place” - Anonymous

Form 15G and Form 15H are the self declaration forms upon submission of which a person can get interest income without deduction of tax at source (TDS). Though the contents of both the forms are more or less similar, yet there are significant differences. Form 15H is for senior citizen individuals whereas form 15G is for others. Each taxpayer needs to fully understand the specified conditions and ascertain whether they are eligible to submit the relevant form. Form No. 15G can be submitted only when (1) the tax on estimated total income is expected to be nil and (2) the aggregate of the interest receivable during the financial year should not exceed the basic exemption limit. Form No. 15H can be submitted if merely the first condition is satisfied i.e., the tax on estimated total income is expected to be nil. In short, Form No. 15H can be submitted even if interest receivable exceeds the basic exemption limit.

There are various instances under the Income Tax Act-1961 where even small casual mistakes can cost you big. One such instance could be with regard to routine submission of Form No. 15G/15H.

One has to take utmost care while submitting these forms. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961, and on conviction be punishable:

1. in case where tax sought to be evaded exceeds Rs. 1 Lacs, with rigorous imprisonment which shall not be less than 6 months but which may extend up to 7 years with fine;

2. in any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend up to 3 years and with fine.

E-filing of Form No. 15G/H by the deductor to the department has been made mandatory. Now, there are every chance that the taxpayer would get caught if they make false submission of Form No. 15G/15H. One has to be all the more careful while submitting these declaration forms.

Form No. 15G & 15H have been recently revised requiring few additional details as can be seen below:

Being new, there appears to be mass level confusion with regards to filling of different columns in the form. At Point No. 15 of Form No. 15H (or Point No. 16 of Form No. 15G), only the amount of income for which the declaration is furnished to the payer is required to be filled.

At point No. 16 of Form No. 15H (or Point No. 17 of Form No. 15G), entire amount of estimated total income (including entire income for which Form No. 15G/15H are submitted, excluding exempt income) is required to be disclosed.

At Column No. 17 of Form No. 15H (or Point No. 18 of Form No. 15G), total number as well as amount for which Forms No. 15G/15H (excluding the one which is submitted to the current payer, which is mentioned in Point No. 15) is required to be shown.

In the illustration given by you, it may be noted that TDS provision is not applicable if the interest payment doesn’t exceed Rs. 10,000/-. At Column No. 15 & 17, “Rs. 20,000” & Rs. “0” would be required be quoted whereas in Column No. 16, Rs. 1,45,000 is required to be shown. Now, suppose a person earns additional interest of Rs. 10,000/-, then in subsequent submission, column No. 15, 17 & 16 would display the amount of Rs. “10,000”, “30,000” & “1,55,000”respectively.

Query 2]

We have some queries regarding new Form 15G/15H.

- 15G Form, if bank customer is mentioning estimated Income of Rs. 2.60 Lacs in column 16 including interest income (Income salary 2.50 Lacs + 10 K Interest on FD), Can he/she get tax waiver on Interest on Fixed Deposit (Eligible of 15G form)?

- 15H form, if customer is below 80 years mentioning estimated Income of Rs. 3.20 Lacs in column 16 including Interest Income (Pension 3 Lacs + 20K Interest on FD), Can he/she get tax wavier on Interest on Fixed Deposit (Eligible of 15 H form)?

- In 15 G form, column 18 mentioned Aggregate amount of Income for which Form No. 15 G filed- Which exact amount will appear in column 18?

Please guide. [Sameet.Samarth@yahoo.co.in]

Opinion:

- TDS on interest payment on bank FDR is required only if interest amount exceeds Rs. 10,000/-. In the given case, as the interest payment by bank is not exceeding Rs. 10,000/-, there is no need of TDS & Form 15G/15H. Imagining Interest payment @ Rs. 11,000/-, Form No. 15G could be filed by the depositor for non deduction of tax at source as (a) Tax on his estimated total income is nil by virtue of deduction u/s 87A and (b) Interest payment is not exceeding the basic exemption limit.

- In the second case, the only condition senior citizen ne needs to fulfill for submitting Form No. 15H is the nil tax liability of the depositor. Since the tax liability is nil by virtue of deduction u/s 87A, depositor could submit Form No. 15H for getting the amount without TDS.

- The amount to be incorporated in column No. 18 is well covered in the query No. 1.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at nareshjakhotia@ssrpn.com.]

|

.png)