|

|

| Article Details |

|

|

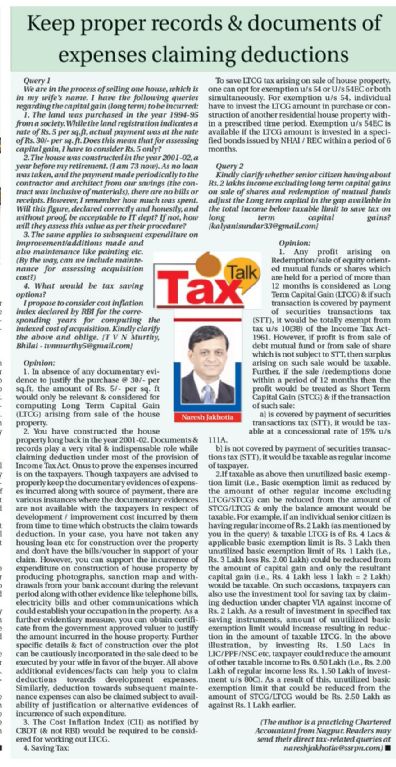

Keep proper records & documents of expenses for claiming deduction |

TAX TALK-06.02.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Keep proper records & documents of expenses for claiming deduction

Query 1]

We are in the process of selling one house, which is in my wife's name. I have the following queries regarding the capital gain (long term) to be incurred:

- The land was purchased in the year 1994-95 from a society. While the land registration indicates a rate of Rs. 5 per sq.ft, actual payment was at the rate of Rs. 30/- per sq. ft. Does this mean that for assessing capital gain, I have to consider Rs. 5 only?

- The house was constructed in the year 2001-02, a year before my retirement. (I am 73 now). As no loan was taken, and the payment made periodically to the contractor and architect from our savings (the contract was inclusive of materials), there are no bills or receipts. However, I remember how much was spent. Will this figure, declared correctly and honestly, and without proof, be acceptable to IT dept? If not, how will they assess this value as per their procedure?

- The same applies to subsequent expenditure on improvement/additions made and also maintenance like painting etc. (By the way, can we include maintenance for assessing acquisition cost?)

- What would be tax saving options?

I propose to consider cost inflation index declared by RBI for the corresponding years for computing the indexed cost of acquisition. Kindly clarify the above and oblige. [T V N Murthy, Bhilai - tvnmurthy5@gmail.com]

Opinion:

1. In absence of any documentary evidence to justify the purchase @ 30/- per sq.ft, the amount of Rs. 5/- per sq. ft would only be relevant & considered for computing Long Term Capital Gain (LTCG) arising from sale of the house property.

2. You have constructed the house property long back in the year 2001-02. Documents & records play a very vital & indispensable role while claiming deduction under most of the provision of Income Tax Act. Onus to prove the expenses incurred is on the taxpayers. Though taxpayers are advised to properly keep the documentary evidences of expenses incurred along with source of payment, there are various instances where the documentary evidences are not available with the taxpayers in respect of development / improvement cost incurred by them from time to time which obstructs the claim towards deduction. In your case, you have not taken any housing loan etc for construction over the property and don’t have the bills/voucher in support of your claim. However, you can support the incurrence of expenditure on construction of house property by producing photographs, sanction map and withdrawals from your bank account during the relevant period along with other evidence like telephone bills, electricity bills and other communications which could establish your occupation in the property. As a further evidentiary measure, you can obtain certificate from the government approved valuer to justify the amount incurred in the house property. Further specific details & fact of construction over the plot can be cautiously incorporated in the sale deed to be executed by your wife in favor of the buyer. All above additional evidences/facts can help you to claim deductions towards development expenses. Similarly, deduction towards subsequent maintenance expenses can also be claimed subject to availability of justification or alternative evidences of incurrence of such expenditure.

3. The Cost Inflation Index (CII) as notified by CBDT (& not RBI) would be required to be considered for working out LTCG.

- Saving Tax:

To save LTCG tax arising on sale of house property, one can opt for exemption u/s 54 or U/s 54EC or both simultaneously. For exemption u/s 54, individual have to invest the LTCG amount in purchase or construction of another residential house property within a prescribed time period. Exemption u/s 54EC is available if the LTCG amount is invested in a specified bonds issued by NHAI / REC within a period of 6 months.

Query 2]

Kindly clarify whether senior citizen having about Rs. 2 lakhs income excluding long term capital gains on sale of shares and redemption of mutual funds adjust the Long term capital in the gap available in the total income below taxable limit to save tax on long term capital gains? [kalyanisundar33@gmail.com]

Opinion:

- Any profit arising on Redemption/sale of equity oriented mutual funds or shares which are held for a period of more than 12 months is considered as Long Term Capital Gain (LTCG) & if such transaction is covered by payment of securities transactions tax (STT), it would be totally exempt from tax u/s 10(38) of the Income Tax Act-1961. However, if profit is from sale of debt mutual fund or from sale of share which is not subject to STT, then surplus arising on such sale would be taxable. Further, if the sale /redemptions done within a period of 12 months then the profit would be treated as Short Term Capital Gain (STCG) & if the transaction of such sale:

a] is covered by payment of securities transactions tax (STT), it would be taxable at a concessional rate of 15% u/s 111A.

b] is not covered by payment of securities transactions tax (STT), it would be taxable as regular income of taxpayer.

- If taxable as above then unutilized basic exemption limit (i.e., Basic exemption limit as reduced by the amount of other regular income excluding LTCG/STCG) can be reduced from the amount of STCG/LTCG & only the balance amount would be taxable. For example, if an individual senior citizen is having regular income of Rs. 2 Lakh (as mentioned by you in the query) & taxable LTCG is of Rs. 4 Lacs & applicable basic exemption limit is Rs. 3 Lakh then unutilized basic exemption limit of Rs. 1 Lakh (i.e., Rs. 3 Lakh less Rs. 2.00 Lakh) could be reduced from the amount of capital gain and only the resultant capital gain (i.e., Rs. 4 Lakh less 1 lakh = 2 Lakh) would be taxable. On such occasions, taxpayers can also use the investment tool for saving tax by claiming deduction under chapter VIA against income of Rs. 2 Lakh. As a result of investment in specified tax saving instruments, amount of unutilized basic exemption limit would increase resulting in reduction in the amount of taxable LTCG. In the above illustration, by investing Rs. 1.50 Lacs in LIC/PPF/NSC etc, taxpayer could reduce the amount of other taxable income to Rs. 0.50 Lakh (i.e., Rs. 2.00 Lakh of regular income less Rs. 1.50 Lakh of investment u/s 80C). As a result of this, unutilized basic exemption limit that could be reduced from the amount of STCG/LTCG would be Rs. 2.50 Lakh as against Rs. 1 Lakh earlier.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at nareshjakhotia@ssrpn.com]

|

|

|

|

|

| |

|

|

|

|

|

.png)