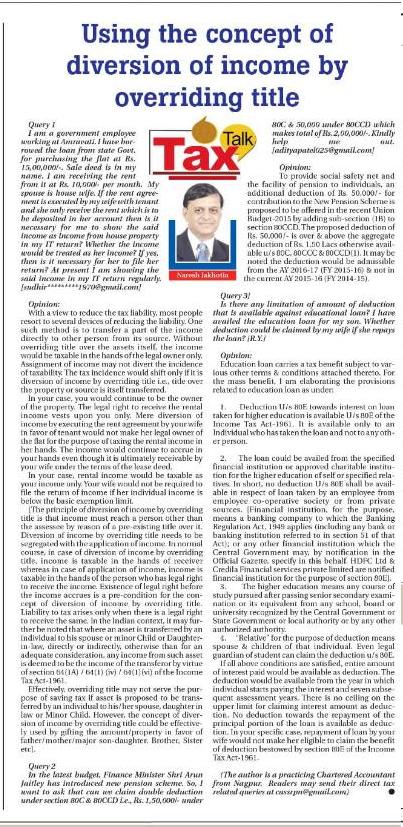

TAX TALK-26.12.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Investment in 5 years fixed deposits also offers tax benefit

Query 1]

As per Income Tax provision, Fixed Deposits falls under section 80C- tax exemption or not? If not, what are the rules? Kindly clarify for the benefit of salaried employee. Second, max life insurance falls u/s 80C tax exemptions or not? [Jayesh kumar Sinha- jaynita98@rediffmail.com]

Opinion:

With March approaching nearer, taxpayers are exploring all the possibilities of saving tax. Section 80C offers tax benefit for investment up to Rs. 1.50 Lakh in specified instruments. Fixed deposits with banks is also one of the simplest, quick, easy & liquid tax saving investment option for the taxpayers. But, all fixed deposits do not offer tax benefit. Only investments done in Fixed Deposits with a scheduled bank for a fixed period of 5 years which is in accordance with the scheme framed & notified by the Central Government qualifies for deduction under section 80C.

Following are the key features of the scheme:

- The lock in period for such a "Tax saving Fixed Deposit" is 5 years & cannot be withdrawn before 5 years period is over. [This is different from any regular Fixed Deposit which can undergo a premature withdrawal].

- Interest rates for such a Fixed Deposit are decided by the respective banks, as is done for a regular Fixed Deposit.

- Tax Saving Fixed Deposit option is available only with the banks. [Investment by way of deposits in Company/ Societies is not eligible for tax savings through Section 80C].

- Maximum of Rs. 1.50 Lakh is exempt u/s 80C, even though the amount of such a deposit can be more than Rs. 1.50 Lakh as well.

- No partial or premature withdrawal is allowed in such a Fixed Deposit. This is much like a Public Provident Fund (PPF) deposit, where the lock-in is permanent till maturity. [Exception: Partial withdrawal is allowed in PPF A/c after some time period].

- The one and only exception for premature withdrawal of such a Fixed Deposit is the death of the investor. In such case, the nominee / legal heir can seek premature closure of the deposit with the bank. The rate of interest applicable in such a case varies from bank to bank.

- Sweep-in or overdraft facility in such a Fixed Deposit is not allowed.

- Only the first account holder, in case of joint accounts, is allowed the tax deduction benefits u/s 80C.

- Deduction is available on the principle amount of investment. The interest earned out of such a Fixed Deposit is fully taxable on an accrual basis, as is with any other fixed deposits. [In PPF/EPF, interest received is totally tax free].

In your specific case,

(a) if investment is done in specified 5 years tax saving fixed deposits then it would be eligible for deduction u/s 80C.

(b) Like investment in other life insurance companies, investment in max life insurance policies is also be eligible for deduction u/s 80C.

Query 2]

We plan to sale agricultural land situated in Taluka-Umrer, Dist: Nagpur which is around 30 KMs from Nagpur. The sale consideration we will receive in installments spread in two financial years. My queries are:-

- The sale considerations will be subject to capital gains tax? (The land was purchased by my parents before 9 years and received by me vide gift deed in March-2013).

- If taxable, then any tax saving option?

- The installment received in financial year should be reflected in concern financial year or in the year the sale is registered?

- The sale consideration will be shown in ITR under which column?

[ravikolhe2011@gmail.com]

Opinion:

To ascertain the taxability of profit arising on sale of agricultural land, one needs to ascertain whether it is a rural agricultural land or urban agricultural land. Entire surplus/profit arising from sale of agricultural land would be tax free if (a) it is from sale of rural agricultural land & (b) it was used for agricultural purpose prior to its sale. The profit on sale of urban agricultural land or Non Agricultural (N.A.) land would be taxable under the head “Capital Gain”.

An agricultural land is considered as rural agricultural land only if it is not situated in any area within the distance (measured aerially) of not more than:

a] 2 Kms, from the local limits of any municipality or cantonment board and which has a population of more than 10,000 but not exceeding 1,00,000; or

b] 6 Kms, from the local limits of any municipality or cantonment board and which has a population of more than 1,00,000 but not exceeding 10,00,000; or

c] 8 Kms, from the local limits of any municipality or cantonment board and which has a population of more than 10,00,000.

With above broad idea about the taxing provision, in your specific case,

- It would be taxable only if the agricultural land is not a rural agricultural land. The tax implication would remain same even in respect of gifted property.

- Tax saving option:

a] On sale of urban agricultural land or non-agricultural land:

LTCG arising on sale of urban agricultural land or non-agricultural land (NA Land) can be commonly saved by claiming an exemption

i] u/s 54EC by investing the amount of LTCG in the bonds issued by NHAI/REC Bonds within a period of 6 months from the date of sale or

ii] u/s 54F, subject to other terms & condition, by investing the amount of net sale consideration for purchase of another residential hose property.

iii] u/s 54B by investing the amount of capital gain towards purchase of another agricultural land within the stipulated time frame. Exemption u/s 54B is available only against sale of agricultural land and no exemption would be available if the non agricultural (N.A.) land is sold.

- Capital gain is chargeable to tax in the year in which “transfer” took place & not on the basis of receipt of sale consideration. Normally, possession is handed over at the time of sale deed & so “transfer” occurs at the time of sale deed and so tax liability would arise at the time of sale deed. Mere receipt of advance money do not make it taxable Advance amount is not required to be reported in case of individual/HUF tax payer who are required to file return of income in ITR-1,2, 2A, 3 or 4S. However, if the sale is of urban agricultural land then it would be required to be shown in the Income Tax return in “schedule-CG“.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at nareshjakhotia@ssrpn.com]

|

.png)