|

|

| Article Details |

|

|

Write up on the controversial issue- whether penalty @ 200% leviable for unaccounted cash deposit: Tax Talk Dated 21.11.2016 |

TAX TALK-21.11.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

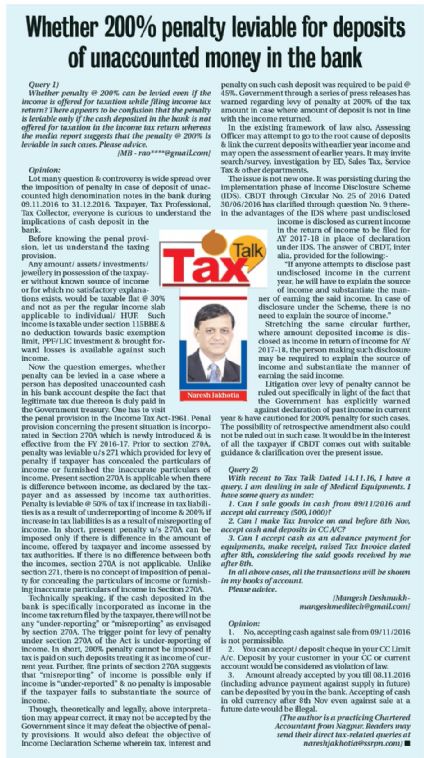

Whether 200% penalty leviable for deposits of unaccounted money in the bank

Query 1]

Whether penalty @ 200% can be levied even if the income is offered for taxation while filing income tax return? There appears to be confusion that the penalty is leviable only if the cash deposited in the bank is not offered for taxation in the income tax return whereas the media report suggests that the penalty @ 200% is leviable in such cases. Please advice. [MB - rao****@gmail.com]

Opinion:

Lot many question & controversy is wide spread over the imposition of penalty in case of deposit of unaccounted high denomination notes in the bank during 09.11.2016 to 31.12.2016. Taxpayer, Tax Professional, Tax Collector, everyone is curious to understand the implications of cash deposit in the bank.

Before knowing the penal provision, let us understand the taxing provision.

Any amount/assets/ investments/ jewellery in possession of the taxpayer without known source of income or for which no satisfactory explanations exists, would be taxable flat @ 30% and not as per the regular income slab applicable to individual/ HUF. Such income is taxable under section 115BBE & no deduction towards basic exemption limit, PPF/LIC investment & brought forward losses is available against such income.

Now the question emerges, whether penalty can be levied in a case where a person has deposited unaccounted cash in his bank account despite the fact that legitimate tax due thereon is duly paid in the Government treasury. One has to visit the penal provision in the Income Tax Act-1961. Penal provision concerning the present situation is incorporated in Section 270A which is newly introduced & is effective from the FY 2016-17. Prior to section 270A, penalty was leviable u/s 271 which provided for levy of penalty if taxpayer has concealed the particulars of income or furnished the inaccurate particulars of income. Present section 270A is applicable when there is difference between income, as declared by the taxpayer and as assessed by income tax authorities. Penalty is leviable @ 50% of tax if increase in tax liabilities is as a result of underreporting of income & 200% if increase in tax liabilities is as a result of misreporting of income. In short, present penalty u/s 270A can be imposed only if there is difference in the amount of income, offered by taxpayer and income assessed by tax authorities. If there is no difference between both the incomes, section 270A is not applicable. Unlike section 271, there is no concept of imposition of penalty for concealing the particulars of income or furnishing inaccurate particulars of income in Section 270A.

Technically speaking, if the cash deposited in the bank is specifically incorporated as income in the income tax return filed by the taxpayer, there will not be any “underreporting” or “misreporting” as envisaged by section 270A. The trigger point for levy of penalty under section 270A of the Act is under-reporting of income. In short, 200% penalty cannot be imposed if tax is paid on such deposits treating it as income of current year. Further, fine prints of section 270A suggests that “misreporting” of income is possible only if income is “underreported” & no penalty is imposable if the taxpayer fails to substantiate the source of income.

Though, theoretically and legally, above interpretation may appear correct, it may not be accepted by the Government since it may defeat the objective of penalty provisions. It would also defeat the objective of Income Declaration Scheme wherein tax, interest and penalty on such cash deposit was required to be paid @ 45%. Government through a series of press releases has warned regarding levy of penalty at 200% of the tax amount in case where amount of deposit is not in line with the income returned.

In the existing framework of law also, Assessing Officer may attempt to go to the root cause of deposits & link the current deposits with earlier year income and may open the assessment of earlier years. It may invite search/survey, investigation by ED, Sales Tax, Service Tax & other departments.

The issue is not new one. It was persisting during the implementation phase of Income Disclosure Scheme (IDS). CBDT through Circular No. 25 of 2016 Dated 30/06/2016 has clarified through question No. 9 therein the advantages of the IDS where past undisclosed income is disclosed as current income in the return of income to be filed for AY 2017-18 in place of declaration under IDS. The answer of CBDT, inter alia, provided for the following:-

“If anyone attempts to disclose past undisclosed income in the current year, he will have to explain the source of income and substantiate the manner of earning the said income. In case of disclosure under the Scheme, there is no need to explain the source of income.”

Stretching the same circular further, where amount deposited income is disclosed as income in return of income for AY 2017-18, the person making such disclosure may be required to explain the source of income and substantiate the manner of earning the said income.

Litigation over levy of penalty cannot be ruled out specifically in light of the fact that the Government has explicitly warned against declaration of past income in current year & have cautioned for 200% penalty for such cases. The possibility of retrospective amendment also could not be ruled out in such case. It would be in the interest of all the taxpayer if CBDT comes out with suitable guidance & clarification over the present issue.

Query 2]

With recent to Tax Talk Dated 14.11.16, I have a query. I am dealing in sale of Medical Equipments. I have some query as under:

1. Can I sale goods in cash from 09/11/2016 and accept old currency (500,1000)?

2. Can I make Tax Invoice on and before 8th Nov, accept cash and deposits in CC A/C?

3. Can I accept cash as an advance payment for equipments, make receipt, raised Tax Invoice dated after 8th, considering the said goods received by me after 8th.

In all above cases, all the transactions will be shown in my books of account.

Please advice. [Mangesh Deshmukh-mangeshmeditech@gmail.com]

Opinion:

- No, accepting cash against sale from 09/11/2016 is not permissible.

- You can accept/ deposit cheque in your CC Limit A/c. Deposit by your customer in your CC or current account would be considered as violation of law.

- Amount already accepted by you till 08.11.2016 (including advance payment against supply in future) can be deposited by you in the bank. Accepting of cash in old currency after 8th Nov even against sale at a future date would be illegal.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at nareshjakhotia@ssrpn.com].

|

|

|

|

|

| |

|

|

|

|

|

.png)