Article Details

| Eligible Start-up - 100% Tax Holiday for 3 years |

|

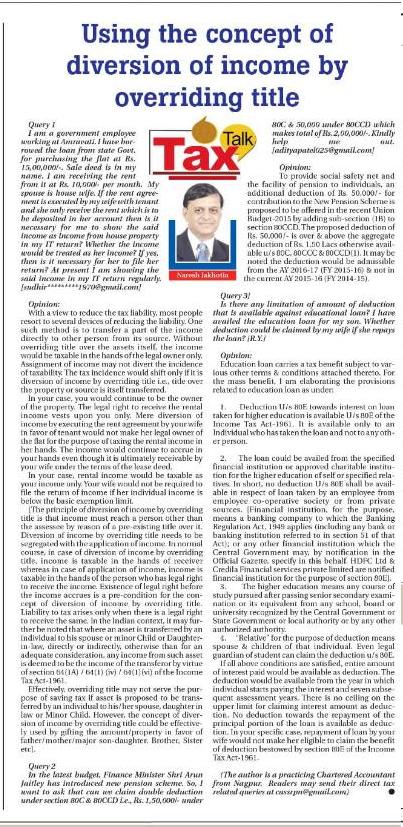

TAX TALK-02.05.2016-THE HITAVADA TAX TALK CA. NARESH JAKHOTIA Chartered Accountant Query 1] Start up India action plan was launched by the PM few months back wherein certain tax incentives in the form of tax free profit was offered. What is the scheme of tax holiday for start up? We are starting up one software firm, whether our profit would be tax free? Any formalities we need to do to avail the benefit? Please advise. [PRK-rao2****@gmail.com] Opinion: Government is very enthusiastic about promoting the entrepreneurship culture in the Country & Start-up India Action Plan (SIAP) was unveiled on 16.01.2016. In line with SIAP, amendments are proposed in the Income Tax Act-1961 by Finance Bill-2016. Section 80IAC is proposed to be inserted in Income Tax Act, which provides for tax holiday to “eligible start ups” for 3 consecutive years. Not all the new businesses are eligible for the tax benefit but only business which involves innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property are eligible for deduction. “Eligible startup” means a company engaged in eligible business which fulfils the following conditions namely a] It is incorporated on or after 01-04-2016 but before 01-04-2019. b] Total turnover of its business does not exceed Rs. 25 crores in any of the years beginning on or after 01-04-2016 to 31-03-2021. c] It holds a certificate from the inter-ministerial board of certification as notified in the official gazette by the government. d] Business should not be formed by splitting up or reconstruction of a business already in existence. e[ It is not formed by the transfer of any used plant and machinery (with some exceptions). If all the conditions are satisfied, deduction of 100% of profits of such start up will be allowed for 3 consecutive years out of 5 years, beginning from the year of incorporation of such eligible startup. The assessee will have the option to select the consecutive 3 years in which it intends to claim this deduction. The sad part, Minimum Alternate Tax (MAT) would still be applicable in the hands of start ups. [There is a mismatch between definitions of Start up as given in Start-Up India Action Plan launched by PM and Definition in Income Tax Act. In the Start Up Action Plan, Private Limited Company, Registered Partnership Firm, LLP were considered for startups whereas LLP & Partnership firms are not considering for granting deduction u/s 80IAC.] Query 2] I am retired Air force Officer and staying in Nagpur in my own house. My father, 93 years old, had purchased a plot for Rs. 18,000/ in 1975 in Secunderabad and constructed a house there for Rs 2 Lakh. We are two brothers. Father is at present staying with younger brother in Bangalore where he is employed in HAL. We want to sell this property which is worth Rs 2 crore. My queries are as follows:

Kindly intimate through "The Hitavada" at the earliest as we want to sell the property very soon. [Gp Capt S Roy Chowdhury (Retd), A- 19 Saroj Nagar, Nagpur-440007-somchowdhury2000@yahoo.co.in]Opinion:

Query 3] I have some queries which I request you to address. I am working in Bank and presently living with my parents. The present residence is in the name of my father. Meanwhile, we sold a property of my aunt for Rs. 34 Lacs and kept it in Capital Gain Account. She is widow and doesn't have any kids. She decided to stay with us and is now living with us. I am the nominee to her Capital Gain Account. Now, we want to purchase one flat for Rs. 36.50 Lacs. The total cost will go up to Rs. 39 Lacs inclusive of Stamp Duty & Registration. Here, my father or me have to put Rs. 5 Lacs from our pocket to meet the expenses of Rs. 39 Lacs to purchase the Flat. The question is, can we buy the joint property with our Aunt as her share is almost 90% without raising any Tax Liability to both? [Sarang Pande- sarang1976@gmail.com] Opinion: Yes, your aunt would be eligible for exemption from Long Term Capital Gain by utilizing the amount kept in Capital Gain Deposit Account Scheme (CGDAS) for purchase of the house property in joint name. It is advisable to mention in the sale deed the share of investment of your aunt in the house property so as to ensure claim for exemption. The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at SSRPN & Co 10, Laxmi Vyankatesh Apartment C.A. Road, Telephone Exch. Square Nagpur-440008 or email it at nareshjakhotia@ssrpn.com. |

|

.png)