Article Details

| Scholarship received to meet the cost of education is tax free |

|

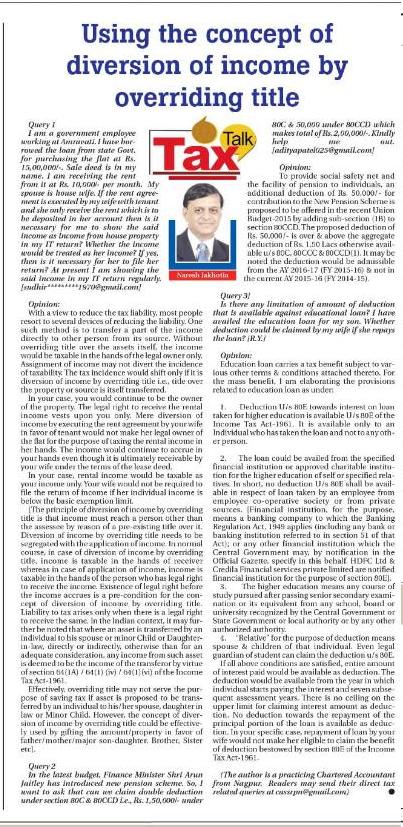

TAX TALK-18.04.2016-THE HITAVADA TAX TALK CA. NARESH JAKHOTIA Chartered AccountantScholarship received to meet the cost of education is tax free Query 1]

“Anyone who stops learning is old, whether at twenty or eighty. Anyone who keeps learning stays young.” ― Henry Ford Income tax Act also recognizes the importance of education & has incorporated provisions that offers tax concessions, as under:

Though the scholarship granted to meet the cost of education is exempt from, its interpretation and scope has been a matter of controversy and debate. Taxability of Scholarship: The question arises whether the amount received by the person for carrying out research activity is also tax exempt? Whether it could be covered by the words “Scholarship granted to meet the cost of education”. If it gets covered, entire amount received would be tax free. We need to examine whether such receipt is in the nature of “scholarship” or not. Scholarship, as ordinarily understood, mean anything which makes education free of charge, or at a concessional rate of fees. However, in section 10(16), scholarship is not used in that sense. It is stretched generously to include the positive payment made to a scholar for pursuing the education. It has been interpreted copiously so to also include within its scope and ambit, amounts of fellowships, stipends, grants for travel and incidental expenses, etc. received for acquiring education. In short, the meaning of word “Scholarship” differs from the popular of dictionary view of “Scholarship”. Central Board of Direct Taxes (CBDT) has suitability clarified the non taxability of amount granted under different schemes to research fellows. Instances of scholarships clarified specifically to be exempt from income tax are:

In the present query, amount proposed to be offered to research fellows (junior and senior) is towards support & furtherance of education and not as an employee of the college. Given the broader meaning & interpretation conveyed by the CBDT from time to time, amount proposed to be offered by your college to this research fellows would be exempt u/s 10(16). There are few more interesting facts about the tax treatment of scholarship as under: a] All education Scholarship are tax free, whether Government sponsored or not. b] The tax treatment would remain unchanged even if the scholarship is received for pursuing a course of education not leading to a degree. [A. Ratnakar Rao Vs. CIT (1981) 6 Taxman 144 (Kar)] c] The essence of scholarship is that it should pay for the educational enterprises of a man’s pursuit after knowledge. The claim for exemption u/s 10(16) will be correct even if some of the amount is saved. [CIT Vs. V.K. Balachandran [1984] 147 ITR 4 (Mad.) d] Research fellowships, grants received from universities may all be exempt when their nature is to support further education. [Dr. Rahul Tugnait v.ITO, appeal No. :ITA NO. 197/CHD/2008 decided on 30.06.2008 by ITAT, Chandigarh Bench`SME-B’] e] Medical scholarship from a foreign university during training programme was held to be exempt u/s 10(16) in A. Ratnakar Rao v Addl. CIT (1981) 128 ITR 527 (Kar) & in Dr. V. Mahadev v CIT (1990) 184 ITR 533 (Mad). Taxability of Stipend: From a purely factual standpoint, there is no mention of ‘stipend’ in the Income Tax Act. so To determine its taxability, one needs to review the terms & conditions of engagement pursuant to which stipend is paid. When an employer-employee relationship exists then the amount would be taxable as Salary even thought the nomenclature of the payment may be stipend or anything else. Further, if the nature of the duties performed are similar to the one performed by the employee & the relationship of employer-employee can be reasonably inferred from the terms & conditions of appointment, then also the amount would be taxable as Salary Income even thought the payment is termed as “Stipend”. In most of the cases, the payment of stipend to Doctor, MBA/Engineering & other Graduates are taxable for these reasons. However, when the Stipend is paid to advance a person’s education and no employer-employee relationship as such persist, then it could qualify as “Scholarship” eligible for exemption u/s 10(16) . Taxability of Stipend received by CA students: There is a case of Sudhir Kumar Sharma vs ITO (1983 15 Taxman 100 Jaipur Mag), wherein it is held that the stipend received by an articled clerk from a chartered accountant is exempt under Section 10(16). The justification given by the bench was that the stipend was paid to meet the cost of books, coaching fees, examination fees, and so on. But the different view is possible as well. It may be considered that the stipend paid by CA firm is not for meeting the expenses of education but for maintaining the cost of living, etc. If this view is adopted by any other court, then stipend will not be able to get the shelter u/s 10(16). This view is also possible where the article assistant receives a higher amount of Stipend in cases such as Industrial training or when students complete final examination before completing the training. Because, they would still be receiving the stipend even after completion of Education. In such cases, amount received could not be considered as for meeting the cost of education & would then be taxable as “Income from Other Source”. To conclude, Stipend received by CA students is exempt pursuant to judicial pronouncement. However, the possibility of different inference could not be ruled out. [The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at SSRPN & Co 10, Laxmi Vyankatesh Apartment C.A. Road, Telephone Exch. Square Nagpur-440008 or email it at nareshjakhotia@ssrpn.com] |

|

.png)