TAX TALK-07.12.2015-THE HITAVADA

TAX TALK

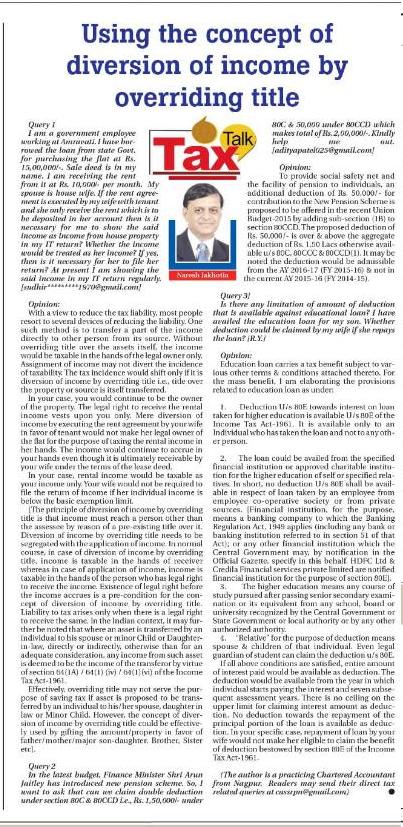

CA. NARESH JAKHOTIA

Chartered Accountant

Housing loan & tax treatment of pre-construction period interest

Query 1]

I have booked flat in under construction project in pune, costing Rs. 52 lacs. The possession is expected in Nov. 2017. Now my question is whether the amount paid to the builder through bank loan (Principal and Interest) before the actual possession of the flat is eligible for tax exemption? If yes, how could I claim the Refund of the said amount? [narayan.parjane@gmail.com]

Opinion:

Housing loan offers tax sops. Interest paid on amount borrowed for purchase/construction of house is eligible for deduction u/s 24(b) of the Income Tax Act-1961 up to a maximum of Rs. 2 Lacs p.a in case of self occupied house property. Earlier, there was a max cap of Rs. 1.50 Lacs which is enhanced to Rs. 2 Lacs by the Finance Act-2014 (for the FY 14-15 & onwards). Additionally, principal repayment of housing loan is also eligible for deduction u/s 80C subject to overall maximum cap of Rs. 1.50 Lacs. Lot many taxpayer are not aware of the fact that even stamp duty, registration expenses etc paid for purchase of a house property is also eligible for deduction u/s 80C, subject to same overall cap of Rs. 1.50 Lacs.

Deduction U/s 24(b):

It may be noted that housing loan taken merely for purchase of plot is not eligible for deduction till the construction of the house property is completed. Only after the construction of the house property, deduction could be admissible. Similarly, mere payment of interest on housing loan taken for purchase of “under-construction” project is not eligible for deduction. Only after the completion of the construction & handover of the possession, deduction would be admissible.

As far Interest of pre-construction is concerned, it is deductible in five equal annual installments commencing from the year in which the construction is completed. “Pre-construction period” means the period commencing on the date of borrowing the amount and ending on 31st March immediately prior to the date of completion of construction /acquisition. If you take the possession of the flat in Nov’2017, preconstruction interest would mean interest for the period commencing from the date of availing loan to 31st March 2017.

[There is one major drawback in case the house property is not completed within a period of 3 years. In such case, deduction towards interest on borrowed capital is restricted to Rs. 30,000/- only & not Rs. 2 Lacs otherwise available in case of self occupied house property].

Deduction U/s 80C:

There is no such stringent bar towards claiming a deduction u/s 80C against Stamp duty/ registration expenses & principal repayment of the housing loan. Deduction could be claimed even if the house property is incomplete. In short, in the FY 2015-16, you would not be eligible to claim deduction u/s 24(b) towards interest payment. However, you can get deduction u/s 80C towards principal repayment of housing loan as well towards stamp duty, registration expenses etc subject to overall cap of Rs. 1.50 Lacs.

Query 2]

I have question related to Capital Gain Tax for your kind advice please.

I had purchased flat in Mumbai in Sept-2009 with registered value of Rs 55 Lakhs. Out of which, I took a home loan of Rs. 42 lakhs and balance funded by me. Now, I want to sell the same to utilize that money to start my business in Qatar. The approximate sale value will be Rs 1.50 Cr as per prevailing market rate. The other information are as under:

- I have been regularly in paying EMI from 2009 till now, every month. The current outstanding loan is Rs 35 Lakhs.

- During last 6 years, I have paid principal of Rs 7 Lakhs and interest of Rs 18 Lakhs.

- I have paid Society maintenance bill of Rs 4 Lakhs since owning the flat.

- I have done renovation at house two times total cost of Rs 4 lakhs, however, I do not have all bills or certification from third party.

- The current valuation of cost as per inflation index, the price of flat is coming to Rs 75 Lakhs.

With above, following are the queries:

- If I sell the property today at Rs. 1.50 Cr., How much would be capital gain tax applicable?

- Can I take rebate on society maintenance charges? I have bills and payment details.

- Can I take rebate on cost of renovation without bill?

- I have paid total Rs 18 lakhs as interest, whereas, I have taken rebate of Rs. 9 Lakhs (Rs. 1.50 Lakhs / year for tax years) in my IT return. Can I take rebate or deduct balance amount of Rs 9 lakhs as cost and deduct from sale proceeds for arriving capital gains tax?

- If I am investing abroad, is there any scheme by RBI / IMF/ Foreign investment promotional body which exempt capital gain tax to promote investment?

- Apart from capital gain tax, do I need to pay any additional tax for remitting the sale proceeds to Qatar for starting business? What kind of documentation / declaration required? Looking forward to your response please. [rosshan.aggrawal@gmail.com]

Opinion:

- Since, the flat is held by you for a period of more than 36 months, it would be considered as “Long Term Capital Assets” and you would be entitled for indexation benefit. The Cost Inflation Index (CII) for the relevant FY 2009-10 & FY 2015-16 are “632” and “1081” respectively. If you transfer the flat before 31st March’2016, capital gain would be computed by taking CII of “1081”. However, if the flat is transferred after March-16, the CII of subsequent year would be relevant & the same would be announced in the next financial year only. Your purchase price was Rs. 55 Lacs. You can further add the stamp duty, registration fees & other expenses incurred while purchasing the flat to arrive at the cost of acquisition. Ignoring stamp duty etc, your indexed cost of acquisition would be Rs.94.07 Lacs (Rs. 55 Lacs*1081/632). Your sale price is Rs. 1.50 Cr and if it is higher than the stamp duty valuation of the property, then Long Term Capital Gain (LTCG) would be Rs. 55.93 Lacs (Rs. 1.50 Cr less Rs.94.07 Lacs). However, if stamp duty valuation is more than Rs. 1.50 Cr, the LTCG would be required to be computed by taking such higher value as sale consideration. LTCG is taxable at a special rate of 20% plus education cess. In short, subject to what is mentioned in (3) & (5) below, your LTCG tax liability on the basis of above calculation would be Rs. 11.52 Lacs.

- No deduction towards the society maintenance charges paid on monthly or annual basis would be admissible while working out LTCG.

- Deduction is available towards all the expenses incurred for renovation or improvement in the house property. However, it is subject to availability of bills, vouchers or other documentary evidences. The onus to prove that the expenses are incurred is on the taxpayer only. If no records or document exists to justify the incurrence of expenses, deduction would not be admissible. In short, taxpayers should keep the bills/vouchers and other records properly as it would be relevant for claiming deduction if the property is sold subsequently.

- Interest & principal repayment of housing loan, whether or not deduction is claimed fully or partly, would not normally be available as deduction while working out LTCG.

- No capital gain exemption is available against investment of LTCG in IMF/RBI or other foreign investment. However, LTCG tax can be saved by investing the amount in the specified bonds issued REC/NHAI within a period of 6 months from the date of transfer. However, there is a lock-in-period of 3 years & ceiling of maximum of Rs. 50 Lacs for investment in these bonds.

- There is no additional income tax payable against remittance of funds abroad to Qatar or elsewhere for starting the business there.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at

nareshjakhotia@ssrpn.com].

|

.png)